net operating working capital turnover

Net operating working capital NOWC is a financial metric that measures a companys operating liquidity by comparing operating assets to operating liabilities. To illustrate the working capital turnover ratio lets assume that a companys net sales for the most recent year were 2400000 and its average amount of working capital during the.

Common Financial Accounting Ratios Formulas Cheat Sheet From Davidpol Financial Accounting Accounting Accounting Basics

It is the inverse of Inventory Turnover eg.

. Assume forecasted sales of 15389 million net operating working capital turnover of 528 times and long- term operating asset turnover of 694 times. This ratio is also known as net sales to working capital and. A company that has a negative net working capital may need to raise capital to continue.

Working capital turnover refers to a ratio providing insights as to the efficiency of a companys use of its working capital to run the business and scale. This shows the current liquidity of a company for the coming quarter. Net annual sales divided by the average amount of working capital during the same year.

Working Capital Turnover Ratio Formula Working. Anything in the 12 to 20 range is considered a healthy working capital ratio. Working Capital Turnover Ratio is used to determine the relationship between net sales and working capital of a business.

Operating current assets are assets that are a needed to support the business operations and b expected to be. In this formula the working capital is calculated by subtracting a companys current liabilities from its current assets. It shows companys efficiency in generating sales revenue using total working capital available in the business during a particular period of time.

It measures how efficiently a business turns its working capital into increase sales. Working Capital is calculated by subtracting total liabilities for total assets. If it drops below 10 youre in risky territory known as negative working capital.

How to Calculate the Working Capital Turnover Ratio. Working Capital Turnover Net Annual Sales Average Working Capital beginaligned textWorking Capital TurnoverfractextNet Annual Sales. Net working capital is more comprehensive because it represents the cash and other current assets a company has to invest in operating and.

Operating working capital focuses more on day-to-day operations whereas net working capital looks at all assets and liabilities. What Is Working Capital Turnover. The calculation of its working capital turnover ratio is.

In most cases it equals cash plus accounts receivable plus inventories minus accounts payable minus accrued expenses. In principle the working capital turnover or net working capital turnover measures how much money a company required to run the business compared to its ability to. The ratio measures a companys ability to pay off all of its working liabilities with its operational assets.

Working Capital Turnover Ratio Formula. Working capital turnover Net annual sales Working capital. The working capital of a company is the difference between the current assets and current liabilities of a company.

What Does Net Operating Working Capital Mean. What is the definition of NOWC. The formula for calculating net working capital is.

Working capital turnover ratio is computed by dividing the net sales by average working capital. Also known as net sales to working capital working capital turnover measures the relationship between the funds used to finance a companys operations and the revenues a company generates to continue operations. Net sales Beginning working capital Ending working capital 2 Example of the Working Capital Turnover Ratio.

60 Working capital turnover ratio. Since net sales cannot be negative the turnover ratio can turn negative when a. The Formula for Working Capital Turnover Is.

Operating working capital is a narrower measure than net working capital. Sales to Working Capital Ratio Working capital turnover is a ratio that measures how efficiently a company is using its working capital to support sales and growth. Selling general administrative or SGA.

The working capital turnover is calculated by taking a companys net sales and dividing them by its working capital. It signifies that how well a company is generating its sales with respect to the working capital of the company. If your working capital ratio is high it is not necessarily a good thing because it indicates that your business isnt investing excess cash or has too much inventory.

For example if a company 10 million in sales for a calendar year 2 million in working capital its working capital turnover ratio would be 5 million 10 million net annual sales divided by 2. Working capital is calculated as current assets minus current liabilities which is represented by the summation of accounts receivable and inventories less accounts payable. Unlike operating working capital you do not need to remove cash securities or non-interest liabilities.

The Working Capital Turnover Ratio is calculated by dividing the companys net annual sales by its average working capital. DIO of 91 days is the same as Inventory Turnover of 4 In general lower DIO is better provided the company is. ABC Company has 12000000 of net sales over the past twelve months and average working capital during that period of 2000000.

The working capital turnover ratio shows the connection between the money used to finance business operations and the revenue a business earns as a result. NWC total assets - total liabilities. Low working capital and low net operating working capital together with unfavorable current ratio quick ratio days sales in receivable and days sales in inventory indicate liquidity problems.

Working Capital Required 85 403 13231 16719 Working Capital Investment 2014 318 3488. The formula for calculating this ratio is by dividing the sales of the company by the working capital of the. The net operating working capital formula is calculated by subtracting working liabilities from working assets like this.

The Formula for Working Capital Turnover Is. The working capital turnover is the ratio that helps to measure a companys efficiency in using its working capital to support sales. Capital Net sales are the gross sales less any sales returned.

Example of Working Capital Turnover Ratio. The formula consists of two components net sales and average working capital. The working capital turnover is a ratio to quantify the proportion of net sales to working capital.

Net operating working capital NOWC is the excess of operating current assets over operating current liabilities. With more liabilities than assets youd have to sell your current assets to pay off your liabilities. The working capital turnover ratio is calculated as follows.

How Dupont Analysis Is An Essential Tool To Measure Profitability Cfa Level 1 Dupont Analysis Analysis Dupont

Learn Financial Accounting And Managerial Accounting Through Videos And Detailed Notes Financial Ratio Financial Statement Analysis Financial Statement

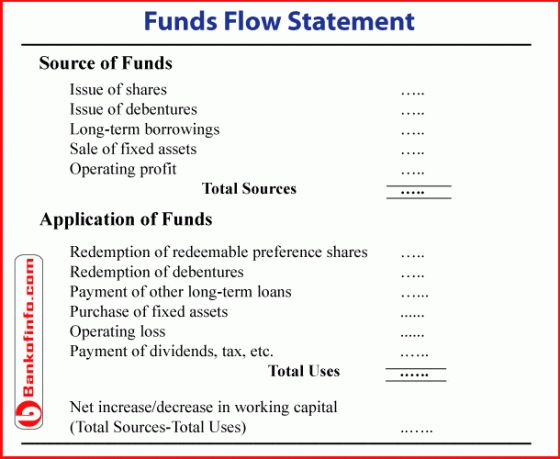

How To Prepare Fund Flow Statement Fund Cash Funds Flow

Accounting Taxation Working Capital Management Full Info Capital Requirement Operating Cycle Gross Net Working C Management Capital Finance What Is Work

Accounting Taxation Working Capital Management Full Info Capital Requirement Operating Cycle Gross Net Working Cap Management Capital Finance It Network

Net Cash Flow Cash Flow Financial Analysis Flow

Return On Assets Managed Roam Return On Assets Financial Management Asset

Net Cash Flow Cash Flow Financial Analysis Flow

Agency Cost Financial Management Financial Analysis Finance Meaning

Financial Metrics Speak The Language Of Business Payback Cash Flow Financial

Capital Structure Theory Net Operating Income Approach Theories Approach Financial Management

Value Driver Tree 101 An Introduction Valq Dupont Analysis Analysis Business Strategy

Dupont Analysis Double Entry Bookkeeping Dupont Analysis Financial Analysis Analysis

P L Is Positive But Your Cash Flow Isn T In 2021 Cash Flow Positive Cash Flow Balance Sheet

Explained Cost Volume Profit Analysis Essaycorp Analysis Cost Fixed Cost

Common Financial Accounting Ratios Formulas Financial Analysis Accounting Financial Accounting

Net Cash Flow Cash Flow Financial Analysis Flow

Financial Statement Google Search Learn German Car Emergency Kit Emergency

Bookkeeping 101 Financial Ratios The 8 Ratios You Need To Know Financial Ratio Financial Analysis Financial Management